How Much Is Bright Money Membership 2026 Benefits & Refund

Bright Money Membership costs $14 per month. You may also go for a quarterly plan, which costs $39 for three months, a semi-annual plan, which costs $68 for six months, or an annual plan, which costs $97 and comes to around $8.08 a month.

Features like debt paydown programs, credit development tools, and credit monitoring are all part of the Premium Membership. A free Basic Membership with restricted capabilities, such credit card management tools, is offered.

About Bright Money

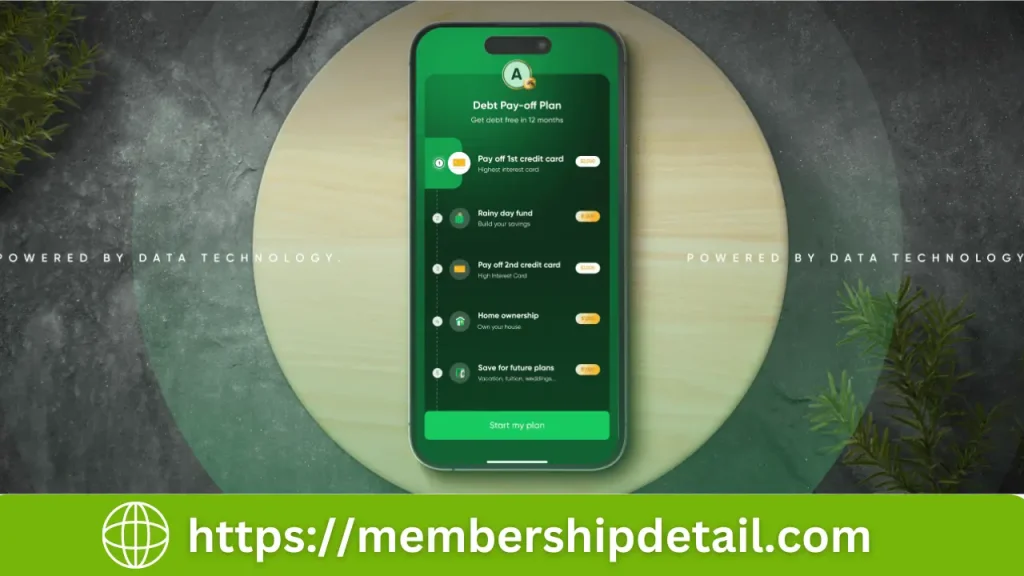

Bright Money is a financial technology tool designed to assist customers in properly managing their finances, lowering debt, and establishing credit. It provides resources including budgeting tools, personal loans, credit building programs, and debt payback plans.

Additional services including credit monitoring, debt paydown programs, rent and bill reporting, and a card manager are available with the Premium Membership. Prices start at $14 a month and go up to $97 a year. The free Basic Membership offers a unified view of all cards and manual credit card payment monitoring for consumers on a tight budget.

Bright Money Membership Plans

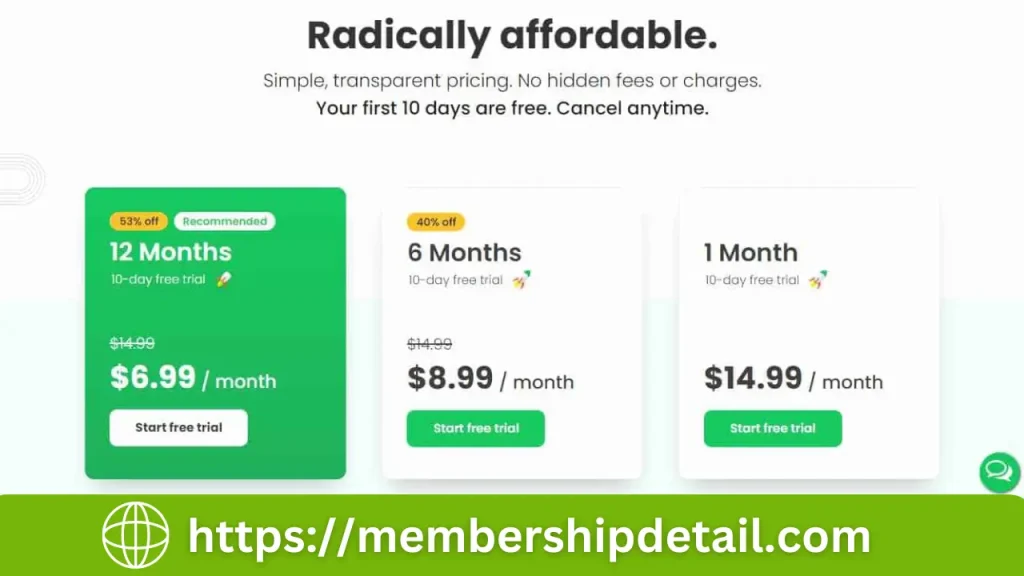

Three membership options are available from Bright Money, each of which is made to accommodate various customer preferences:

Monthly Plan

After a complimentary 10-day trial, the $14.99 monthly plan is invoiced every 30 days. For customers who would rather not commit to longer-term subscriptions, this plan offers flexibility.

Six-Month Plan

It is $8.99 a month, with semi-annual billing of $53.94 every six months. For people who are ready to pay in advance for a longer period of time, this plan is a cost-effective alternative because it offers a reduction when compared to the monthly option.

Annual Plan

It is $6.99 a month, with an annual charge of $83.88. When compared to other plans, this one offers the best monthly value, making it the most cost-effective choice for loyal customers.

| Plan | Cost per Month | Billing Frequency | Total Cost per Billing Cycle |

| Monthly Plan | $14.99 | Monthly | $14.99 |

| Six-Month Plan | $8.99 | Every 6 months | $53.94 |

| Annual Plan | $6.99 | Annually | $83.88 |

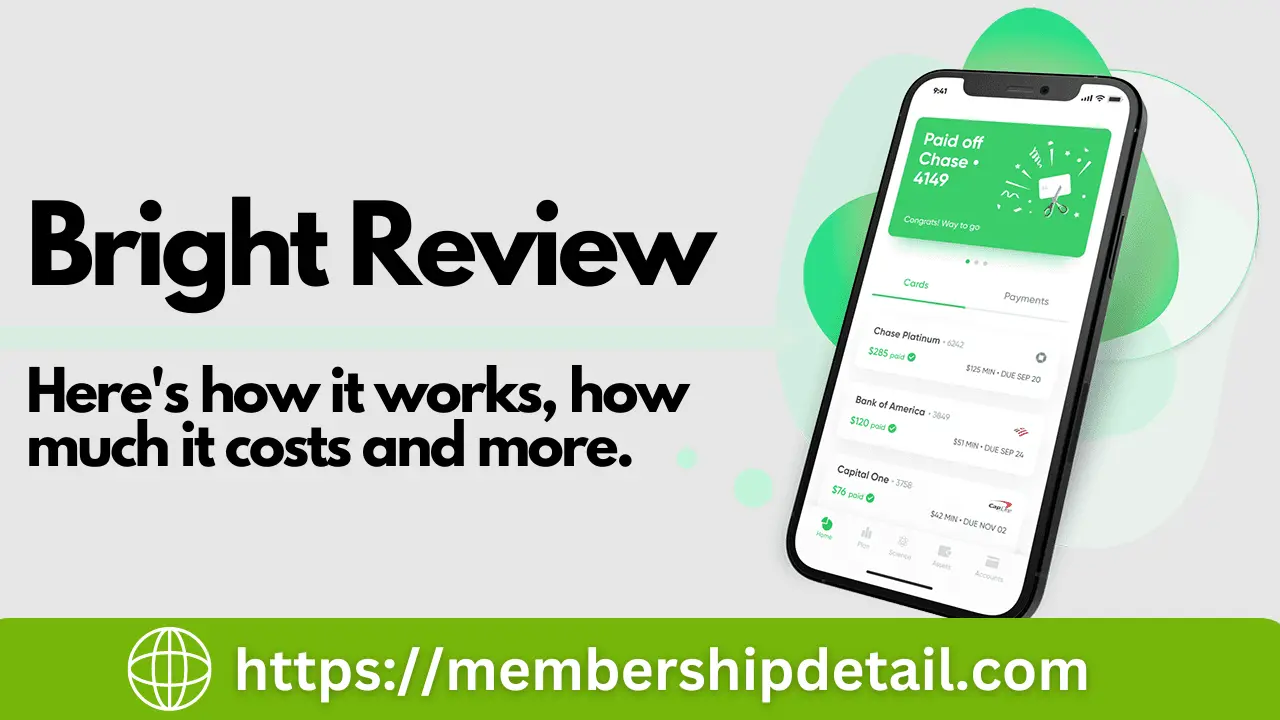

How Does Bright Money Work

Bright Money manages and optimizes debt repayment, savings growth, and financial planning through the use of AI-driven financial solutions. This is how it works:

Bright Money Loan App

The Bright Money Loan App allows users to browse various personal loan offers from third-party sources and compare rates, conditions, and fees to get the best deal. Through Bright’s network of financial partners, which provide loans on their own, the app makes debt consolidation easier.

The “Bright Credit” line of credit allows users to combine debts into a single, lower-interest repayment plan and pay off high-interest credit cards. The credit limit is between $500 and $8,000, and the annual percentage rate (APR) is 9%.

Is Bright Money Membership fraud?

The goals of the financial management software Bright Money are to assist users save money, manage debt, and raise their credit ratings. Spending tracking, better credit ratings, and automatic credit card payments are some of its benefits. With an A+ rating from the Better Business Bureau and 4.1 to 4.6 stars on sites like Trust-pilot, the app has received positive reviews.

Users have, however, voiced worries around unforeseen fees and problems with customer support. While some customers complained that they were billed for late fines or yearly subscriptions, others said that problems were resolved satisfactorily. Bright Money has a mediocre reputation overall.

Bright Money Membership Review

An AI-powered financial management tool called Bright Money has functions including credit-building and debt-reduction automated transfers. It analyzes customers’ income and spending patterns using AI, enabling them to save money and pay off credit card debt. By informing credit bureaus of timely payments, the app also assists users in establishing credit, gradually raising their credit ratings. A user-friendly interface and customizable debt payback plans are options available to users.

However, some customers could be put off by the monthly membership charge, the fact that it isn’t compatible with all banks and financial institutions, and the fact that it can’t report to major credit bureaus. The app’s ability to establish credit may be hindered by delayed transactions and insufficient reporting.

Bright Money Contact Details

Bright Money Social Media Links

FAQs

How much is a Bright money membership?

Bright has three subscription plans: $6.99/month when paid yearly, $8.99/month when paid semi-annually, or $14.99/month when paid monthly. Bright also offers a free 10-day trial.

How do I cancel my bright money subscription?

You may always cancel your subscription in the app to remove your account. Another option is to temporarily pause Bright. Please use our live chat feature or send an email to support@brightmoney.co to reach our customer success team.

How do you qualify for a Bright credit card?

You have to be at least eighteen.

A current Social Security number is required.

You have to live in a state where we have a lending license.

Does Bright money give advances?

Flexibility is added to the world of cash advances through lines of credit provided by lenders such as Bright Money.

What credit score is needed for Bright money?

Good (660–799): A high credit score puts you in a favorable position to get approved for a personal loan with favorable conditions.